Save tax up to ₹75,000~ u/s 80D

Save tax up to ₹75,000~ u/s 80D

It is pure bliss to have ageing parents at home and gain the blessings they shower upon us. There is no denying that parents brave all challenges to shape our lives, guiding us through various phases. They gave us the best of everything, even before we could ask for it. Now, as they step into the golden years, it is our foremost responsibility to give them the medical attention they deserve, as ageing catches up and brings unavoidable health issues. Therefore, investing in health insurance for parents will keep them financially safe during their retirement years and give you peace of mind.

Having best health insurance for parents entitles your ageing parents to secure their savings by availing of tax benefits. Besides, if they are above 60 years, they can get a higher Section 80D deduction limit on the health insurance premium, up to Rs 50,000 per year, and a total deduction up to Rs 1 lakh, if the proposer and insured in a floater plan are above 60 years. Indeed, old age is a crucial stage when your parents need the utmost care and financial support. That is achievable if you choose a health cover or mediclaim for parents specifically designed to cover the hefty hospital bills they are likely to incur due to an ailment, injury, or an existing condition.

The rising age-related health issues and medical inflation make medical insurance cover all the more essential. Health insurance for parents is a separate health cover that you can opt for your ageing parents and get maximum coverage for various medical treatment expenses. The parents health insurance includes several benefits, like cashless hospitalisation, daycare treatments, annual health check-ups, and alternative treatment, while protecting your savings during unforeseen medical emergencies.

You can opt for an individual plan, a family floater cover, or senior citizen health insurance if your parents are above 60. With prior planning and some research, we can help you find the best health insurance plan for parents in India to secure a healthy future for your elder ones.

Depending on the specific healthcare and insurance requirements, you can choose the best health insurance for parents. Here are some customised medical insurance policy for parents for your aged parents:

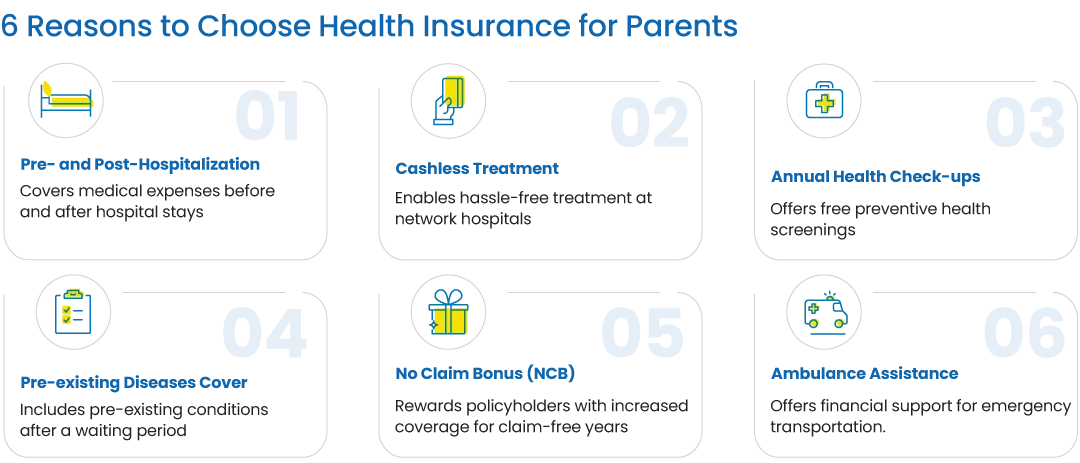

You can now provide the best medical care for your ageing parents without facing any financial hurdles. The high-risk factor due to coronavirus and medical inflation are some challenges facing all of us right now. Thus, while choosing the best mediclaim policy for parents, look for the following benefits-

Seeing parents grow older is bound to have an emotional impact on most of us. Also, we realise that our parents require constant support and timely care for a happy and healthy life during old age. While we shower them with abundant love and care, offering financial support can become challenging, especially during medical emergencies. Your parents may be dependent on you monetarily. Besides, getting quality medical treatment in India is an expensive proposition. That is why you need a support system to safeguard your family’s future in times of adversity.

A medical insurance for parents acts like a safety cushion that lets your loved ones manage health crises without worrying about expenditures. Also, a good healthcare cover enables you to get quality medical care to treat your parent's illnesses most affordably. As ageing people are at a greater risk of facing illness and poor health conditions, it is wise to opt for condition-specific health insurance plans for parents. Moreover, the chances of hospitalisation due to a pre-existing medical condition, chronic ailments, or surgeries are higher in old age. These health plans for parents offer various financial benefits and thus let you focus on delivering care and comfort to your parents.

There are different health insurance plans you can get for your parents. However, a suitable health insurance policy must include coverage for pre-existing diseases, cashless hospitalisation, and a higher sum insured. Consider these factors when buying a health insurance for parents:

So, look for a good mediclaim policy for parents by considering various factors such as low copayment amount, age, policy inclusions, and exclusions, waiting period, and the premium. Make a selection of the plan that best suits your requirements and also has add-on benefits. Also, check for an easy payment mode and claim settlement process. Finally, submit the essential documents and complete the formalities on time, so the policy can benefit your parents when need be.

No need to schedule countless appointments for discussing policy details. Care Health Insurance offers an all-digital policy selection experience wherein you can study, compare, choose, and pay for the best health insurance for parents from anywhere, anytime.

The CHI team is readily available for all your queries concerning the terms and conditions of our healthcare policies. You can use the live chat option to discuss any policy-related matter at your convenience.

We facilitate digital premium and coverage calculators to help you opt for customised parents health insurance.

We provide digitally secure payment options, including credit/debit cards, or net banking. Once issued, you shall receive authentic policy documents immediately.

What we promise on paper is what you get in times of medical and healthcare needs. Our parents’ healthcare policy comes attached with all the terms and conditions for your ready reference.

While browsing online through our healthcare policy for parents, you can easily check out other add-on benefits. These include COVID and OPD care, co-payment waiver, reduced wait time, among others to cover your specific needs.

Avail health cover for your senior citizen parents so that they can access the best medical facility during any emergency hospitalisation. You get the choice to pick an individual or a floater option and get the following coverage and benefits:

21600

Cashless Healthcare Providers^^

48 Lakh+

Claim Settled**

100%

In-house settlement for better management

7 Crore+

Lives Covered Since Inception

24 X 7

Claim Support

Buying an insurance policy for parents is a wise decision as you have ensured that you get the possible medical facility for them without burning a hole in your pocket. When reviewing an option, remember to check the various scenarios, also called exclusions, that mention the expenses the policy will not cover. The exclusion of our parents’ healthcare insurance are listed below:

The insured person should be:

| Criteria | Eligibility |

|---|---|

| Minimum Entry Age | 61 years |

| Lifelong Renewability | 99 years |

| Initial Waiting Period | 30 days |

| Pre-existing Waiting Period | 36 months |

Mentioned below are the vital documents that need to be submitted for availing of a mediclaim policy for parents:

Your elderly parents might know all the secret recipes for ageing gracefully and yet miss out on some crucial health risks. Here are some health tips for senior citizens:

Look for hospitals around you

Getting the best medical insurance for parents in India now takes only a few clicks. You can reach out to us via call, and our health experts will assist with the overall buying process digitally.

It is not advisable to include senior citizen parents in a family floater plan. This is because the premium in family floater policies, as well as the renewability, is based on the age of the eldest family member. So, covering a senior citizen parent in a family floater plan will burden you with higher premium costs.

Yes, you can get mediclaim for parents by opting for an individual health cover that will give adequate coverage and protection against medical expenses. CHI offers a customised health cover, Care Freedom, for those having diabetes/hypertension.

You can renew the health insurance for parents online. Here are the steps to follow:

You can get a claim for parents under the mediclaim policy in two ways - cashless claim and reimbursement claim. Here are the steps to avail of the cashless facility:

Here are the steps to avail of the reimbursement claim facility:

There are no pre-policy medical check-ups required for choosing a medical policy for senior citizen parents. However, the underwriter may recommend a pre-medical check-up in some cases.

Yes, the premium paid towards health insurance for parents is eligible for tax deduction under section 80D. With a senior citizen mediclaim policy, a person can avail a deduction of Rs 50,000 in a year and a maximum deduction up to Rs 1 lakh if the proposer and insured are senior citizens. The tax exemptions are subject to the rules and regulations of the Income Tax Act.

There is no maximum limit on the entry age to get health insurance for parents. It provides the lifelong renewability option, and one can get continuous coverage through regular policy renewal.

Yes, you can get a senior citizen health plan for your father even if he is 67 years old. This plan is specifically created for people who are over 60.

Pre-existing condition is defined as any medical condition or injury that a person has before the commencement of a new health insurance plan.

Yes, there are various health insurance options for seniors with PEDs. You can purchase a health insurance plan even for your parents, although the premiums will be a little high. Care Freedom is one such comprehensive health insurance policy for senior citizens and individuals with pre-existing medical conditions.

**Number of Claims Settled as of 31st March 2024

^^Number of Cashless Healthcare Providers till Feb 2025

^10% discount is applicable for a 3-year policy

*Premium calculated for an individual (Age 61) for sum insured 5 Lakhs in Zone 2 cities.

Get the best financial security with Care Health Insurance!

Sales:1800-102-4499

Services: 8860402452

Live Chat